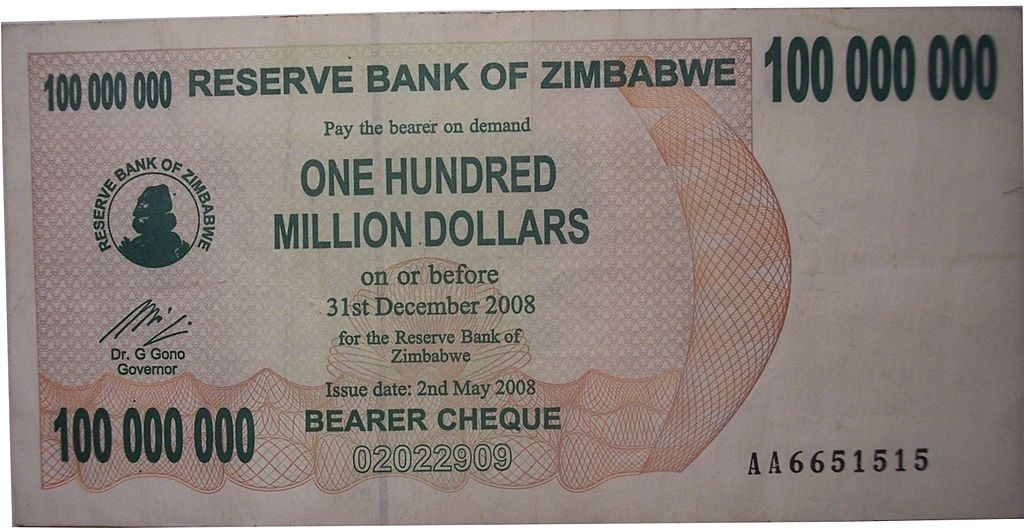

On June 24th, the Zimbabwe government banned local trading in foreign currencies with immediate effect. The move includes the US dollar, which much of Zimbabwe adopted after the Zimbabwean dollar was abandoned following the 2009 hyperinflation crisis. Although it has been common knowledge that the Zimbabwean dollar would return in the near future, few anticipated foreign currencies being banned with such immediacy.

It’s been a real shock to the system for Zimbabweans who have relied heavily on the US dollar and the South African rand in recent years. However, the Zimbabwean president believes that while a “multi-currency regime” was important to “stabilise the economy”, without a local currency Zimbabwe has had no control of its monetary policy; leaving Zimbabweans “at the mercy of US dollar pricing”.

At the time of hyperinflation, the Zimbabwean dollar was pegged to the US dollar, but the reality was that the former was worth far less. This resulted in a burgeoning black market, while much of Zimbabwe has sought to become a cashless society, based on mobile and card transactions. According to most fiat currency platforms, one Zimbabwean dollar is currently worth just under three hundredths of a dollar ($0.0027). However, the nation’s traders on the black market have pegged the value of one US dollar to 11 Zimbabwe dollars. If and when the Zimbabwean dollar returns to the forex market, the technical trading signals will take some time to settle on a value against the US dollar with so many government fundamentals muddying the waters.

Image: Wikimedia Commons

In a bid to breathe new life into the Zimbabwean economy, the government renamed digital cash and bond notes as RTGS dollars in order to provide a more legitimate alternative to the black market. However, as locals started to be paid their weekly or monthly wages in RTGS dollars, it was soon discovered that RTGS dollars couldn’t keep up with inflation.

It was therefore the government’s decision to ban the use of US dollars, as the authorities believed the strength of the US dollar made production and manufacture of goods in Zimbabwe cost-prohibitive, leading to the mass import of goods and subsequent rising unemployment levels. The RTGS dollar was then reclassified as the new Zimbabwean dollar and the country’s sole legal tender. While supermarkets and other retailers have adopted the new currency quickly despite the lack of government notice, street vendors have insisted that they would rather see the bond note scrapped and continue to accept the US dollar.

David Coltart, lawmaker for the Opposition Movement for Democratic Change (MDC), described the government’s decision as “sheer madness”. Mr Coltart warned that the government is unable to “force people to love a currency” and that their decision to ban all other foreign currencies was a sure-fire way to “exacerbate the chaos”.

The Zimbabwe Congress of Trade Unions (ZCTU) is already urging the government to rethink its decision and pay workers in US dollars, with the threat of nationwide protests from staff quite possible. There were widescale protestations at the vast price increase in fuel at the turn of the New Year, so the government should be left in no doubt of the seriousness of the situation.