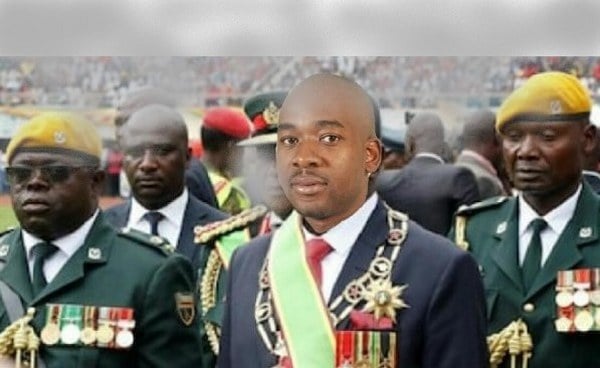

There has been calls for former Citizens Coalition for Change (CCC) president Nelson Chamisa to fight President Emmerson Dambudzo Mnangagwa’s regime head-on following last year’s disputed polls.

Chamisa has been accused of being too soft on Mnangagwa and his regime, with some urging him to call for massive protests.

Critics have been telling him that oppressors do not hand over power easily without the oppressed putting a fight.

However, despite the calls, Chamisa had been relatively silent saying time will come when he will deal with the Mnangagwa regime without the use of force.

Meanwhile, Chamisa has hinted when he would take Mnangagwa who is nicknamed crocodile head-on.

“AFRICAN WISDOM…You don’t challenge a crocodile when one of your legs is still in water. Blessed Friday!”

Apparently, after being asked where the country is heading, Chamisa hinted that Zimbabwe is set to have new leadership soon.

“There will be a new leadership for our great nation. It will make sense soon,” he said.

Be that as it may, Chamisa has added his voice with regards to the plan by government to introduce structured currency, saying it is bound to fail as it doesn’t address economic fundamentals.

He writes:

THE STRUCTURED CURRENCY AND CURRENCY BOARD TOO LITTLE AND TOO LAME!

The currency crisis Zimbabwe faces is basically a crisis of CONFIDENCE. This confidence deficit crisis can’t be addressed by setting up currency board nor establishing a structured currency framework. This is why previous efforts which include the introduction of bond note, gold coins and ZIG failed dismally.

Regarding the asset-backed currency, I must express deep skepticism. This strategy is a rehash of previous failed attempts. The introduction of gold-backed digital coins and gold coins has already proven ineffective, leading to the discounted sale of gold and contributing to the smuggling of precious resources out of our country. Moreover, the lack of transparency surrounding this process only fuels suspicion and undermines public trust.

As for the proposed currency board my assessment of where this has happened successfully shows that the success hinges on accountability, transparency, and adherence to legal instruments qualities sorely lacking in Zimbabwe’s current governance.

The pervasive state policy inconsistency erodes confidence in the system’s integrity. Without these critical success factors in place, the currency board is doomed to fail.

For avoidance of doubt, I know that currency boards have been used in over 38 countries with notable success because of the “confidence effect” especially in circumstances where credible people of integrity and high standing were appointed into the board.

I am also aware that currency boards work well in circumstances where central bank holds sufficient foreign which will match demand for foreign currency at a pegged exchange rate.

Our situation is so dire because it is characterized by a confidence deficit, exogenous shocks (drought & subdued commodity prices) which have a net effect of depleting our forex will weaken the effectiveness of the so – called structured currency and currency board.

It’s clear that the they are resorting to ineffective fiscal and monetary policies as the economy continues to suffer from currency leakage and a lack of value generation, exacerbated by the refusal to implement a single currency status and abandon the flawed interchange auction system.

Instead of tinkering with ineffective superficial solutions, Zimbabwe needs genuine comprehensive political and economic reforms that prioritize accountability, transparency, and the rule of law. Only then can we build a stable and prosperous economy for everyone.

Zwnews