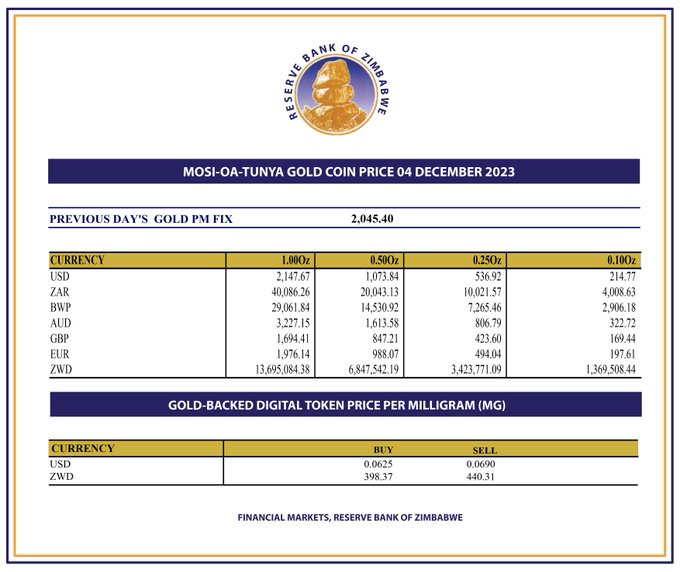

The Reserve Bank of Zimbabwe (RBZ) has released the latest prices of gold coins and gold backed digital tokens.

The tokens are sold in US dollars and local currency, but the latter shall be at a 20% margin above the willing-buyer willing-seller interbank mid-rate, RBZ recently said in statement.

Also sometimes referred to as a crypto token, digital coin, or often simply, token or coin, a digital coin is a digital representation of value (in Zimbabwe’s case backed by gold) or rights that is offered and sold for the purpose of facilitating access to, participation in, or development of a distributed ledger, blockchain, or other digital data structure.

Speaking after their introduction, RBZ governor John Mangudya said the gold-backed digital tokens were fully backed by physical gold held by the central bank.

“The issuance of the gold-backed digital tokens is meant to expand the value-preserving instruments available in the economy and enhance divisibility of the investment instruments and widen their access and usage by the public,” he said.

Depreciation of local currency, due to excessive demand for the greenback as a store of value, has largely been blamed for driving resurgent price (increases) and exchange rate volatility.

The bank also advised that the pricing of the gold-backed digital tokens in foreign currency shall remain the same as the pricing model of the physical gold coins whilst payment for the gold-backed digital tokens or physical gold coins in Zimbabwe dollar shall remain at the current 20 percent margin above the interbank mid-rate.

Zwnews