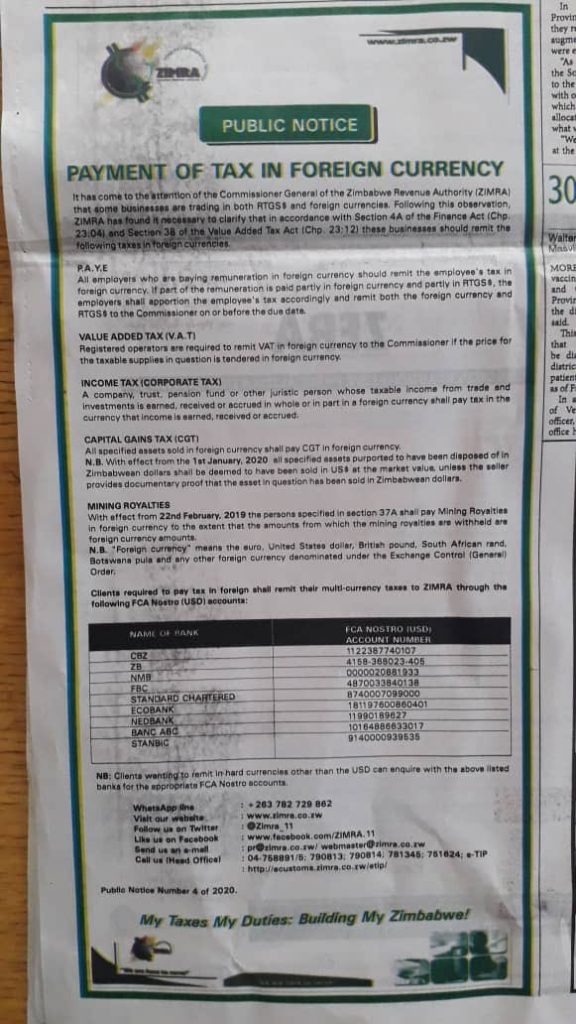

It has come to the attention of Zimra that some businesses are trading in both RTGS and foreign currency. Following this observation Zimra has found it necessary to clarify that in accordances with the Finance Act, these businesses should remit the following taxes in foreign currency:

- PAYE: If employees are paid in forex, PAYEE must be in forex

- VAT: If the taxable supplies are in forex then VAT should be paid in forex

- Income Tax – if you are trading in forex income tax should be remitted in forex

- Capital Gains Tax – properties sold in forex must pay CGT in forex, property sold in ZWL will be presumed to have been sold in forex unless proof is produced that they were sold in ZWL

- Mining Royalties – to be paid in forex as specified by section 37A

pindula