The Zimbabwean dollar (Zimdollar) has continued to gain strength against the American dollar on the Reserve Bank of Zimbabwe (RBZ) foreign currency auction system.

From the results of the auction conducted yesterday, the local currency traded at about ZWL4.700 to the green buck.

However, market watchers say the gain is artificial caused by the government’s withdrawal of the local currency from the market.

Recently, the RBZ confirmed that there was a shortage of Zimdollars on the market.

Meanwhile, renowned American economist Steve Hanke has called on the Zimbabwean government to mothball the RBZ and adopt the US dollar in order to improve the country’s economy.

Hanke says Zimbabwe is experiencing its 3rd period of hyperinflation in 15 years, adding that since January ’22, the Zimdollar has depreciated against the USD by ~97%.

He says Zimbabwe is in 1st place in this week’s Hanke’s #CurrencyWatchlist.

The local currency has for long been performing badly against major convertible currencies such as the American dollar, with some calling for its dumping.

But, President Emmerson Dambudzo Mnangagwa is on record saying he won’t dump the Zimdollar, further stressing that the country could rather drop the US dollar.

In that light, economic agencies that are betting against Government policies are likely to suffer heavy losses as Treasury remains adamant that the current policy measures and the firming local currency trajectory will continue for longer.

Some businesses are still using exchange rates of between $8 000 and $11 000 per greenback in their pricing despite the official exchange rate firming to below $5,000.

However, some economic agencies argue that selling at the new exchange rates will see them record huge exchange rate losses given they stocked when rates were too higher.

Instead, the businesses are choosing to hold on to their stocks, pricing their products at rates double the formal exchange rate.

In the process, aggregate demand has tumbled with fewer customers at the tills.

While some of the businesses are happy to keep their merchandise priced at higher exchange rates than sell at a loss, there is risk that they will eventually suffer huge losses if the current trajectory lasts longer than they are anticipating.

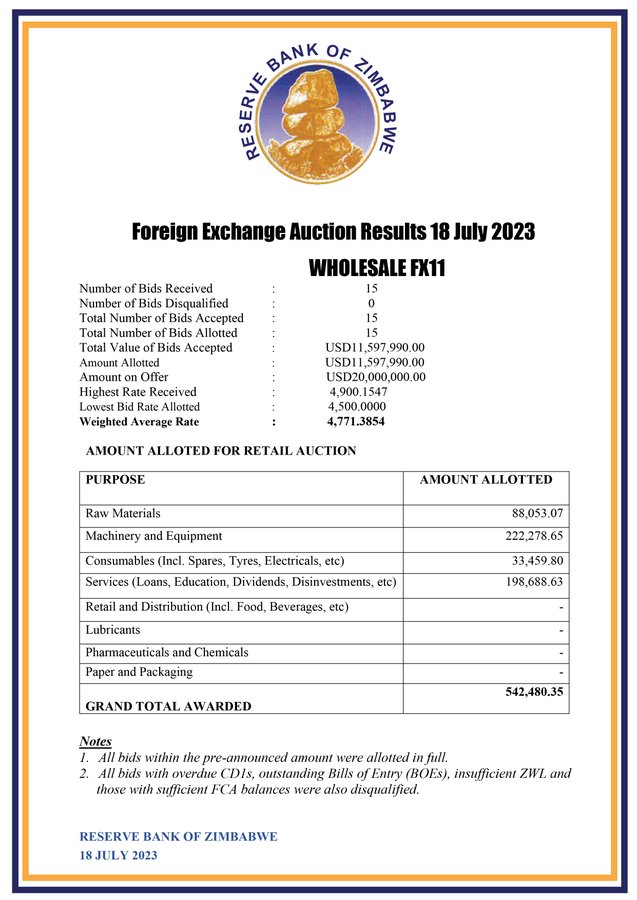

In its quest to achieve lasting price stability, the Government recently introduced the wholesale foreign currency exchange auction system which allows banks to access foreign exchange at market-determined exchange rates for onward transmission to their customers.

This liberalised trading environment allowed the market to stabilise while at the same time, the Zimbabwe dollar appreciated.

Zwnews