Lovemore Lubinda

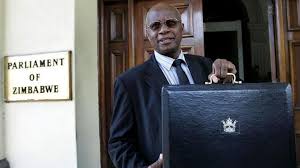

As the 2017 national budget for Zimbabwe preparations gathers momentum, some analysts have implored the Finance and Economic Development Minister Patrick Chinamasa to bring in policies that promote economic growth, and not to try to increase it, as there are limited funds at his disposal owing to the dwindling tax base, the major source of government revenue.

In September 2016 the ministry rolled out consultative meetings to hear the public’s views and their input as to what they expect to see in the 2017 national budget.

The portfolio committee held public consultations at Tendai Hall in Bindura. Tinevimbo Marodza an economic analyst, who participated at the meeting, recently told Zim News over the phone that the minister should bring policies that will ensure the enhancement of farming productivity. “The important thing that his budget should tackle is promote farming so that our agro based economy can be revived. This will feed the down-stream value chain,” she said.

She said giving priority to the productive sector as opposed consumptive is the only way to go when faced with limited fiscal space to manoeuvre.

A developmental advocate Virginia Muwanigwa, who was speaking at a journalist training workshop on Sustainable Development Goals policy reporting last week, agrees, and she said it is indeed vital to note what to prioritise when distributing limited resources like the national budget, which has been declining over the years.

“It would be unsound to give the bigger chunk of the budget to for instance the defence ministry, when not at war, or when there is crisis in the health sector, or when there is crisis in the education sector,” she said.

Some analysts are of the belief that the minister will be tempted to increase the budget, as he will be expecting lines of credit opening up after the country’s clearing of the International Monetary Fund arrears.

According to a renowned economist Dr Gift Mugano the Zimbabwe’s national budget for the past 5 years is ever decreasing because of dwindling tax base for the treasury to boost its coffers. Therefore he warns that it is important for the minister to put more effort in policies that enhances value chain capacitating, rather than trying to increase it.

He says tax free incentive for the production and manufacturing sector to grow is what is needed, and this lead the government to get more through Value Added Tax (VAT) as people buy more of the materials they need, while at the same time reviving the production sector.

He believes lack of confidence has led people keeping out cash from the banking system, adds that this need to be addressed by policies that boost confidence. Just as pointed out by Muwanigwa, he urges the monetary authorities to give priorities to critical ministries such as health, etc, rather than defence or on government officials trips.

Mugano also told a Zimbabwean radio station last week that the minister should instead tax more on the mining companies that are exporting raw minerals, saying by this, the country is failing to benefit much as compared to exporting value added minerals.

For the past 5 years Zimbabwe’s budget was premised on the economic stabilisation phase, and not growth phase this was because of the macro-economic conditions attaining in the country, and all growth forecasts had to be later revised downwards. The expenditure especially salaries was the major beneficiary from the past budgets.