The Secretary to the Public Service Commission (PSC), Ambassador Jonathan Wutawunashe recently announced that the Government Employees Mutual Savings Fund (GEMS) loan facility is ready to rollout from 1 May 2021.

In a statement, Ambassador Wutawunashe highlighted that qualifying members of the voluntary fund, who have made contributions for three consecutive months can, on 1st of May 2021, apply for loans.

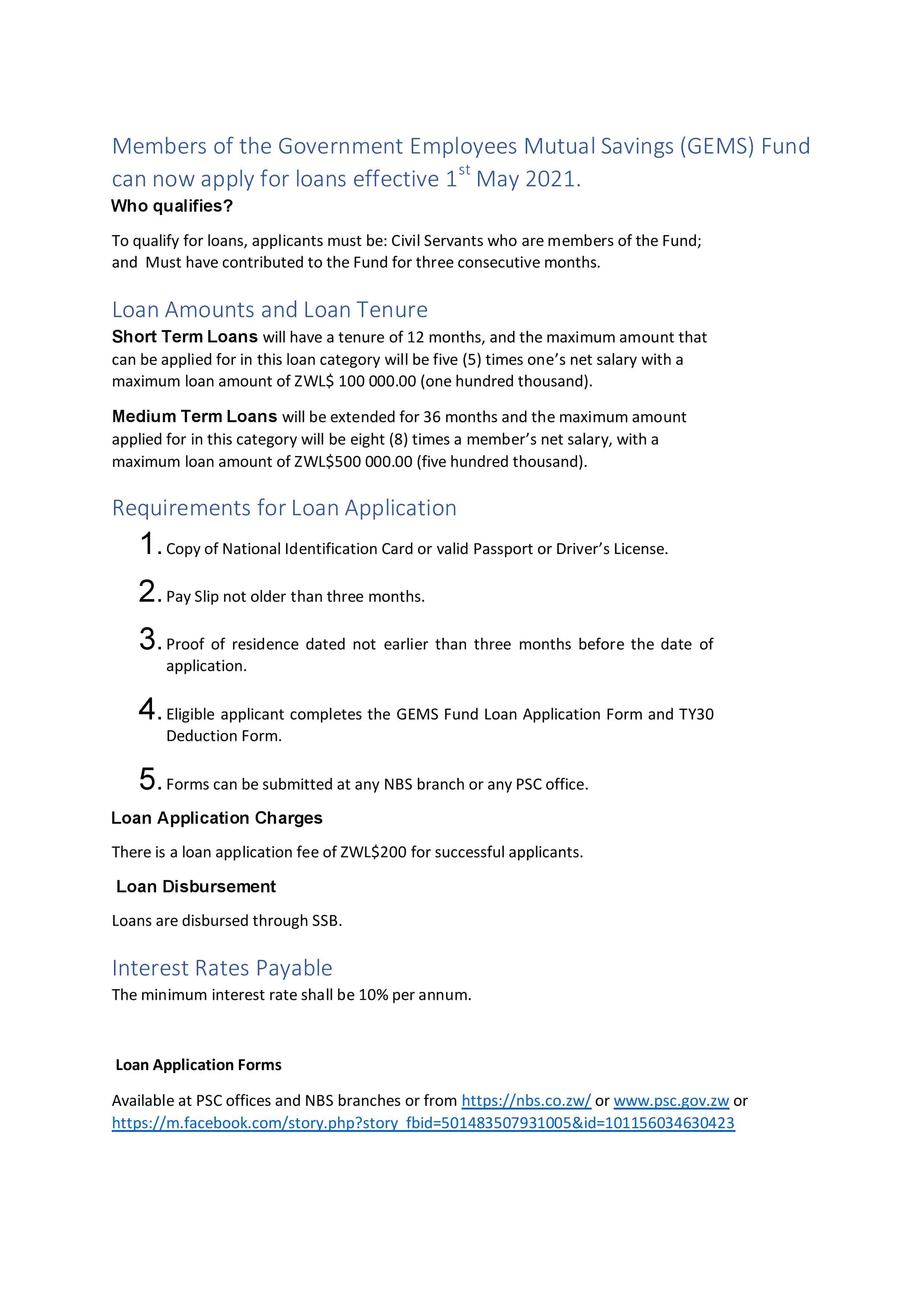

The statement below shows terms and conditions of the loans and how to apply:

The objective of the fund is to encourage members to accumulate savings through small monthly amounts, provide financial assistance to members and enhance financial flexibility and security for members.

Under this facility, civil Servants make monthly committed deductions from salary into a ring-fenced Pool.

These monthly contributions are ring-fenced as Capital Contributions which will accumulate and will be held as his or her share of savings in the pool for the account of the member.

The deductions will be tied to one’s grade in the civil service. The grading system will then also define the benefit levels/ loan limits.

Upon exiting from the fund on termination of employment, or from voluntary exit through the opt out option, employees will access the full residual capital contributions and all accumulated interest less any loan obligations that they may have.

Wutawashe, said GEMS members can also collect and submit application forms at any National Building Society Bank (NBS) branch nationwide or from PSC offices nearest to them.

Applicants should attach copies of Identification Card or valid passport or drivers licence; a Payslip not older than three-months and fill the GEMS Loan Application Form and TY30 deduction form.

-Zwnews