The Reserve Bank of Zimbabwe (RBZ) Monday moved to further liberalise the foreign exchange market by allowing individuals and companies to sell foreign currency to banks on a willing buyer willing seller basis.

The bank also increased interest rates as part of pro-active measures to ease inflation increases.

An update released by the RBZ governor John Mangudya shortly after the RBZ Monetary Policy Committee (MPC) meeting confirmed the latest development, which is anticipated to cripple black market foreign currency trades.

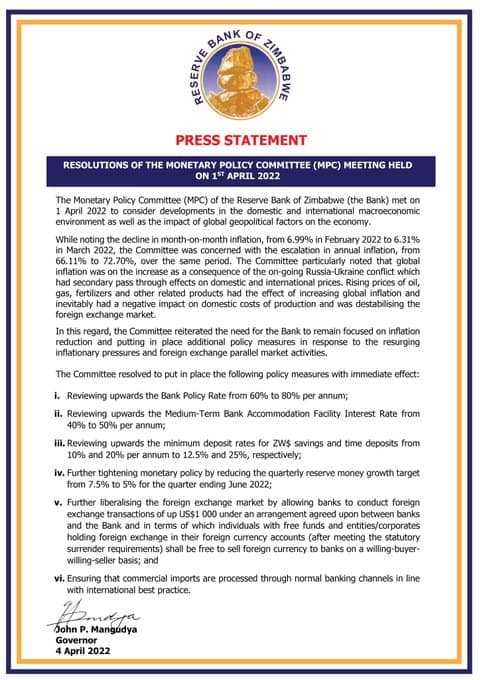

“Further liberalising the foreign exchange market by allowing banks to conduct foreign exchange transactions of up to US$1 000 under an arrangement agreed upon between banks and the RBZ, in terms of which individuals with free funds and entities or corporates holding foreign exchange in their foreign currency accounts shall be free to sell foreign currency to banks on a willing buyer willing seller basis,” Mangudya said.

Market watchers believe that the move will further broaden companies’ access to foreign currency over and above the weekly auctions and in the process, move trades from the invisible shadows of the streets which normally lead to unfounded speculative exchange rates hikes.

The central bank also hiked interest rates as part of measures aimed to contain inflationary pressures prompted by the Russia/Ukraine war by blocking anticipated borrowings which may in turn lead to money supply growth and destabilize the markets.

In this regard, the MPC reiterated the need for the bank to remain focused on inflation reduction and putting in place additional policy measures in response to the resurging inflationary pressures and foreign exchange parallel market activities.

Under the new arrangements, the bank policy rate was increased from 60% to 80% per annum while the Medium Term Bank Accommodation facility interest rate was increased from 40% to 50% per annum.

The MPC reviewed upwards the minimum deposit rates for US$ savings and time deposits form 10% and 20% to 12,5% and 25% respectively.

Reserve money growth rates targets were further tightened by reducing the set target of 7, 5% by setting it at 5% for the quarter ending June 2022.