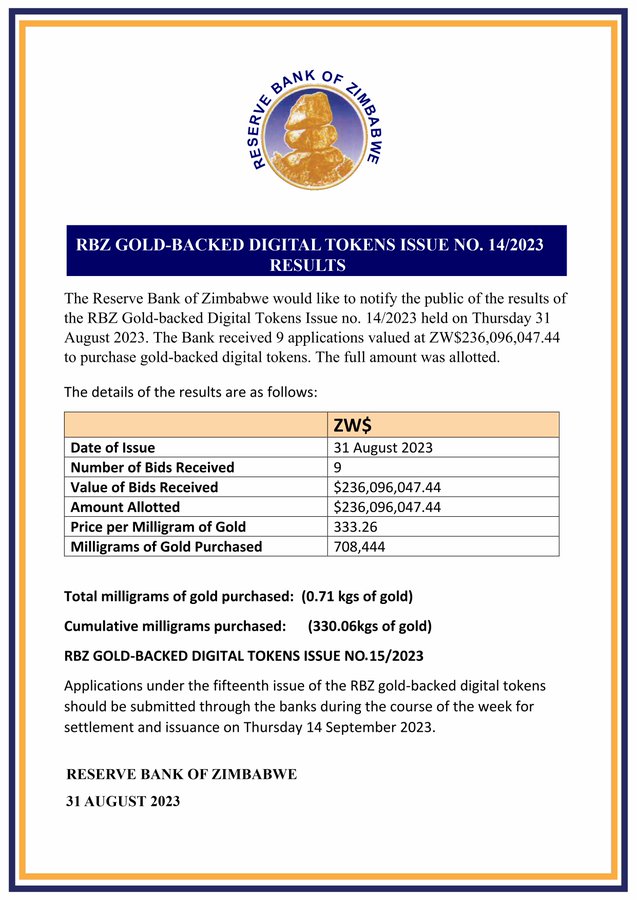

The Reserve Bank of Zimbabwe (RBZ) has published the results of Gold-backed Digital Tokens results as at 31 August 2023.

In a public notice, the central bank gave some highlights on how bids were made and allotted.

Gold-backed Digital Tokens is a new electronic money, backed by gold bullion that is guided by the international gold price as determined by the London Bullion Market Association (LBMA) and held at the RBZ.

According to the central bank, this has been introduced to stabilise the local currency, ostensibly allowing citizens to exchange modest amounts of local currency.

Applications for the RBZ Gold-Backed Digital Tokens must be for a minimum of US$10 for individuals and US$5,000 for financial institutions, corporates and other entities.

Application forms are available from RBZ, Commercial Banks, Building Societies and the People’s Own Savings Bank (POSB).

The tokens can be purchased through local banks, with transactions enabled via “e-gold wallets or e-gold cards” held by banks. Tokens held on these cards will be tradable and capable of facilitating person-to-person (P2P) and person-to-business (P2B) transactions and settlements, such that the gold-backed digital tokens can be used both as a means of payment and a store of value.

On May 8, RBZ began issuing gold-backed digital tokens as legal tender to stabilise the Zimbabwean dollar (ZWL) and protect citizens’ purchasing power.

But while this new currency may reduce reliance on the US dollar and potentially lower exchange-rate volatility, many believe it will prove inadequate in solving Zimbabwe’s deep-rooted economic problems, amid calls for full dollarisation.

Zwnews