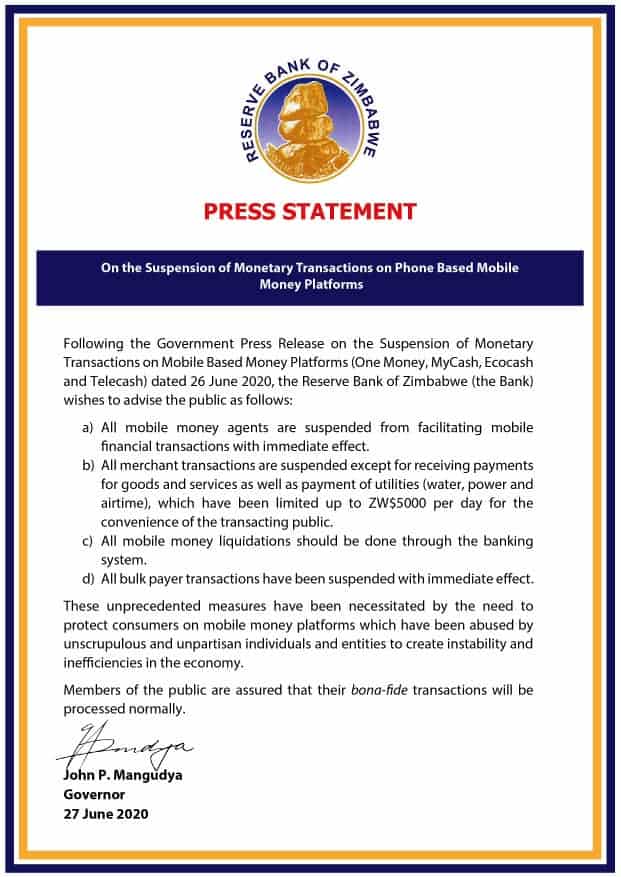

Reserve Bank of Zimbabwe (RBZ) Governor John Mangudya has defended the controversial move by the Government to suspend monetary transactions on phone-based mobile money platforms saying the move seeks to protect consumers who were being abused by ‘unpatriotic’ individuals bent on creating instability on the economy.

The central bank boss also specified that the move has effected the suspension of all merchant transactions except for receiving payments for goods and services, including payment of utility bills which have been limited to ZW$5000 per day.

“These unprecedented measures have been necessitated by the need to protect consumers on mobile money platforms, which have been abused by unscrupulous and unpartisan individuals and entities to create instability and inefficiencies in the economy,” said the RBZ Governor.

Mangudya said the latest developments will see all mobile money agents being suspended from facilitating mobile financial transactions with immediate effect.

He also advised that all mobile money liquidations should be done through the banking system while all bulk payer transactions have effectively been suspended.

See the RBZ Statement attached below:

Zwnews