THERE was high drama after Reserve Bank of Zimbabwe (RBZ) governor John Mangudya, in a fit of rage, tossed paper files at Finance minister Mthuli Ncube and walked out of a meeting, angrily slamming the door as tempers flared in an episode that left top government officials stunned at a meeting called by the Treasury chief last week.

The Zimbabwe Independent can reveal that a dramatic personal confrontation erupted between Mangudya and Ncube after sharp differences emerged over the direction to take on the monetary policy front, amid concerns the central bank governor could reverse fiscal gains recorded to date.

Highly-placed sources narrated a vivid account of the verbal showdown between Ncube and Mangudya inside Treasury, in the presence of various officials from the apex bank and the Finance ministry who were left astounded. Mangudya had been summoned by Ncube to brief him on the draft policy statement, before he could obtain Mnangagwa’s approval to officially present the monetary policy statement.

Sources said Mangudya insists on maintaining the “current” parity trading ratio between the greenback and the bond note, a move Ncube believes does not make “economic sense” in light of how the surrogate currency is rapidly losing value against the US dollar. Ncube is pushing for the liberalisation of the exchange rate which entails the floating of the local unit against the greenback.

“Mangudya and his team from the RBZ were summoned to Treasury so that he could brief the Finance minister on the draft MPS before officially presenting it last week (February 7). As he was presenting the major highlights of the policy statement, it became very clear that Ncube, even as he sat on his chair calmly, was not impressed.

Midway through John’s presentation, Ncube interjected, pointing out that the policy statement was not comprehensive and that it did not holistically address the challenges buffeting the economy.

“Ncube spoke calmly but robustly, lecturing Mangudya as though he were his university student, that it would be catastrophic to maintain the equivalent trading ratio between the bond note and the US dollar. Perhaps fed up with being treated like a student, Mangudya rose from his chair, tossed a bunch of papers in the direction of Ncube and left the room with his team in tow. There was deathly silence in the room, and people only became alive to what had happened after JPM (Mangudya) stormed out,” an insider told the Independent this week.

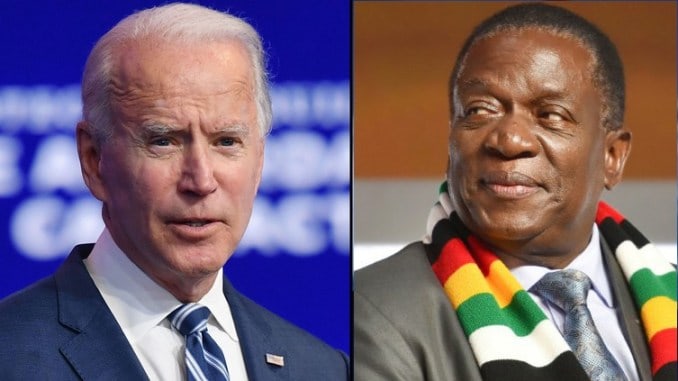

Sources say the angry exchanges between the two prompted President Emmerson Mnangagwa this week to intervene by convening a series of meetings at his offices where Ncube and Mangudya were instructed to quickly iron out their differences and present the policy statement next week.

“The two have seen HE (His Excellency Mnangagwa) more than three times this week so that they could resolve their difference to make way for the presentation of the MPS next week,” a senior Finance Ministry official said.

“What I know is that JPM (Mangudya) has always been used to making his own decisions and sometimes controlling Treasury which appears is no longer the case.”

Sources said Ncube is very concerned with what he viewed as policy indiscretions on the part of Mangudya relating to his planned monetary policy.

He wants Mangudya’s policy to complement his fiscal measures aimed at ensuring there is a budget surplus, reduced current account deficit and an end to monetary policy expansion.

Key among his objectives is to “sterilise” money supply growth by ensuring no new money is created by the central bank.

“Mthuli wants a monetary policy that complements what he is doing on the fiscal side,” another Treasury source said this week. “He is running a budget surplus and is working to close the current account deficit. He wouldn’t want a monetary policy that undoes that. He also believes the country is in this mess because of fiscal indiscipline on the part of government.”

Sources added that Ncube also feels that Mangudya directly aided Zimbabwe’s monetary expansion policy that saw the creation of billions in bond notes, Treasury Bill issuances and electronic balances.

“The major differences between Ncube and Mangudya stem from monetary expansion due to fiscal imprudence. Ncube wants to sterilise money supply growth. Mangudya used to control Treasury. This is no longer the case and they are not seeing eye-to-eye.”

Mangudya was by law supposed to present the MPS at the end of January or in the first week of February, but was stopped from doing so by Ncube, who advised that the draft policy statement by the apex bank chief did not address concerns raised by various stakeholders during consultative meetings, and lacked clarity on the rational evaluation

between the bond currency and the US dollar.

Last week, Mangudya told the Independent that he had scheduled presentation of the policy statement on February 7.

However, sources said Mangudya was “instructed to go back to the drawing board” by the Treasury chief who felt the draft MPS was not comprehensive during a meeting held in the Finance minister’s office.

Policy differences between Ncube and Mangudya range from the efficacy of re-introducing the Zimbabwean dollar, re-dollarisation, joining the Rand Monetary Union and liberalisation of the exchange rate, among other contentious issues.

Mangudya, who separated bank balances in the local unit from accounts denominated in foreign currency in his MPS last year, is pushing for the re-introduction of the local dollar, a move that Ncube disapproves on account that key macro-economic fundamentals should first be addressed before Zimbabwe can take that path.

Ncube has said the southern African country, reeling under a volatile currency crisis, could reintroduce its local currency within 12-18 months once the macro-economic environment is stabilised.

Former finance minister Tendai Biti tweeted that government was planning to re-introduce the local currency this week, drawing the ire of officials from the apex bank and Treasury.

Contacted for comment, Mangudya downplayed his angry exchange with Ncube, noting that he had a “cordial and warm working relationship” with the minister.

“I am not aware of any meeting between myself and the President yesterday. I am not aware of any differences between myself and the minister. We have cordial relations,”

Mangudya said, adding that the MPS would be presented in “due time”.

Presidential spokesperson George Charamba did not respond to the text message sent to him while his mobile phone rang unanswered.

Biti told the Independent that although Mangudya wanted to announce the return of the local currency in his MPS, he was advised on the serious ramifications of such a move on the country’s creaking economy.

“The reason why there has been a delay is that they have been caught pants down by my tweet. They were flagrant. The delay is helping the economy because what government was doing was putting poison into the economy. It was going to introduce disaster in the economy because there have been no economic fundamentals, no exports and government is spending available money like aphrodisiac,” Biti said.

“There are differences between the approach of the Minister of Finance and the approach of the Governor of the Reserve Bank. The Finance minister has openly blamed the RBZ governor John Mangudya for sponsoring quasi-fiscal activities which have contributed to the large chunk of the budget deficit.”

Biti highlighted that the only viable route Zimbabwe could take to end its intractable currency crisis was to adopt the South African rand with the central bank abandoning the financing of “quasi-fiscal activities.”

“It is common knowledge that the RBZ is the centre of the problems in Zimbabwe,” he said. “We don’t need the RBZ. In fact, the RBZ should be shut down. I handled that

Ministry without the assistance of the RBZ. They need to strengthen the use of the multi-currency regime and pursue the option of the Rand Monetary Union.”

The yet-to-be-presented MPS is expected to give direction on interest rates, exchange rate, currency crisis and rising inflation.

Ncube’s austerity measures, spelt out in his maiden budget statement, coupled with Mnangagwa’s announcement of a 150% fuel price increase last month which triggered unrest, courted public anger and triggered violent nationwide protests in January.

Sources say government officials are apprehensive about a restive population’s unpredictable reaction should Mangudya announce a policy statement that deepens Ncube’s austerity measures.

On the positive, Ncube is now running a budget surplus and working on clearing the current account deficit.

theindependent